Antigua and Barbuda are a Caribbean Island nation that is part of the Commonwealth. The lush tropical islands of Antigua and Barbuda, with their 365 beaches and clear blue waters, are an appealing paradise and widely regarded among the most attractive places on the planet. As a result, the tourist industry is the island’s biggest source of income, accounting for over 60% of total revenue, with the United States, Canada, and Europe serving as significant target markets.

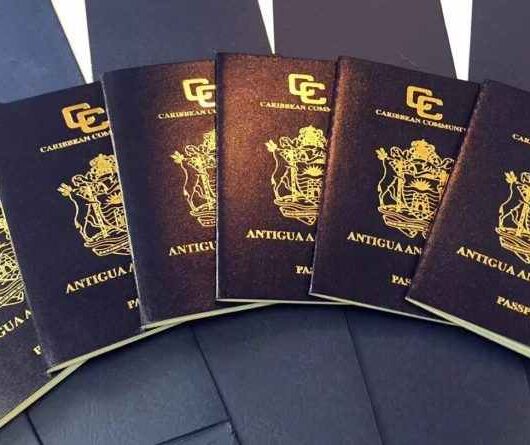

Antigua and Barbuda are a member of various international organizations, including the United Nations, the British Commonwealth, Caricom, and the Organization of American States (OAS). Visa-free traveling is available to Antigua and Barbuda passport holders in about 150 countries, including the United Kingdom and Schengen countries.

The Honorable Prime Minister of Antigua and Barbuda established the Citizenship by Investment Unit (CIU), which is the government institution in charge of evaluating all applications for Agent’s Licensing and Citizenship by Investment by applications and their families.

The best Caribbean passport program provides lifetime citizenship to international clients who invest in the country under the contribution of USD 100,000 and the Real Estate Investment Program USD 200,000.

Within 3-4 months, the visa processing is completed

The passport, which was first given with a 5-year validity period, can be simply renewed for a modest charge ($350).

Antigua and Barbuda’s Permanent Residency Program was established in 1995 to attract rich individuals to establish tax residency in the island.

It is exclusively open to non-citizens and offers a quick path to Antiguan tax residency.

Antigua and Barbuda’s Permanent Residency Program has the following requirements:

- Have a permanent address in Antigua and Barbuda.

- Spend a good 30 days in Antigua and Barbuda each year.

- A minimum annual income of $100,000 is required.

- Pay a yearly flat tax of $20,000

Antigua and Barbuda Investment Options

The citizenship by investment program was approved by the government as one of the strategies to boost the economy, attract expansions, raise foreign direct investment, support industrial development, and maintain a sustainable future. As a result, investors can choose from a variety of possibilities to be considered for the program.

- Contribution to the National Development Fund or a Charitable Donation

High-net-worth individuals can donate US$100,000 (for up to four people) or US$125,000 (for five or more people) to the National Development Fund or an approved charity. A spouse and all qualified dependents may be included in the primary applicant, but government and due diligence requirements apply to each individual involved.

- Property Investment

Applicants should invest a minimum of US$400,000 in a governmental real estate development area. The investment should be sustained for five years. In addition to the purchase price of the property, the candidate is also expected to pay for its registration, processing fees, and taxes.

- Starting a business

Applicants are expected to invest up to US$1.5 million in their business. Two or more individuals may make a joint capital investment of at least US$5 million with an individual requirement of nearly Us$400,000.

- Fund for the University of the West Indies

A family of six (6) can seek citizenship for an investment of US$150,000. The investment amount includes governmental expenses as well as processing fees. However, each qualified dependent is still subject to standard due diligence fees. Furthermore, one member of the family is qualified for a one-year scholarship at the University of the West Indies. For larger families, there are additional government processing fees.

Changes in Original Citizenship

There are no limits on dual citizenship in Antigua and Barbuda. However, you should check with your present home nation to see if dual citizenship is permitted.

Tax-efficient Benefits of Antigua & Barbuda Citizenship

The following are some of the advantages of tax residency in Antigua and Barbuda:

- There is no income tax on worldwide earnings or assets.

- There is no capital gains tax on global income or assets.

- There is no global or asset inheritance tax.

- There is no wealth or asset tax everywhere in the world.

Why A2W Consultants?

If you have any queries or would need a thorough analysis of your family’s specific costs, feel free to contact A2W Consultants, and we would be happy to assist you. If you want to become a citizen of Antigua and Barbuda through investing, here are some convincing reasons why A2W is the best partner for you!

- Everything we do is based on professionalism and ethics.

- We have specialized teams of lawyers and tax consultants who can provide you with unbiased advice to facilitate a smooth transfer.

A2W consultants have streamlined very complex citizenship applications throughout the years, making us your best bet to work with.

At A2W Consultants, we will carefully and diligently guide you through every step of the citizenship acquisition, confirming that your application is submitted correctly and that it is followed up on until it is approved. Get in touch with us right away!